Shopify Balance

Your business financial account

All-in-one financial management, faster payouts, and zero fees.1 Open your account in minutes—FREE.

Shopify partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust and Fifth Third Bank, Members FDIC. Shopify Balance Visa® Commercial Credit cards are powered by Stripe and issued by Celtic Bank pursuant to a license from Visa U.S.A. Inc.

Meet Shopify Balance

The free business financial account built right into your Shopify admin.

Your money could be earning more

Get rewarded in the form of an annual percentage yield (APY) on all the money held in your Balance account.2

3.39%

Basic, Shopify, and Advanced plans

4.43%

Plus plan

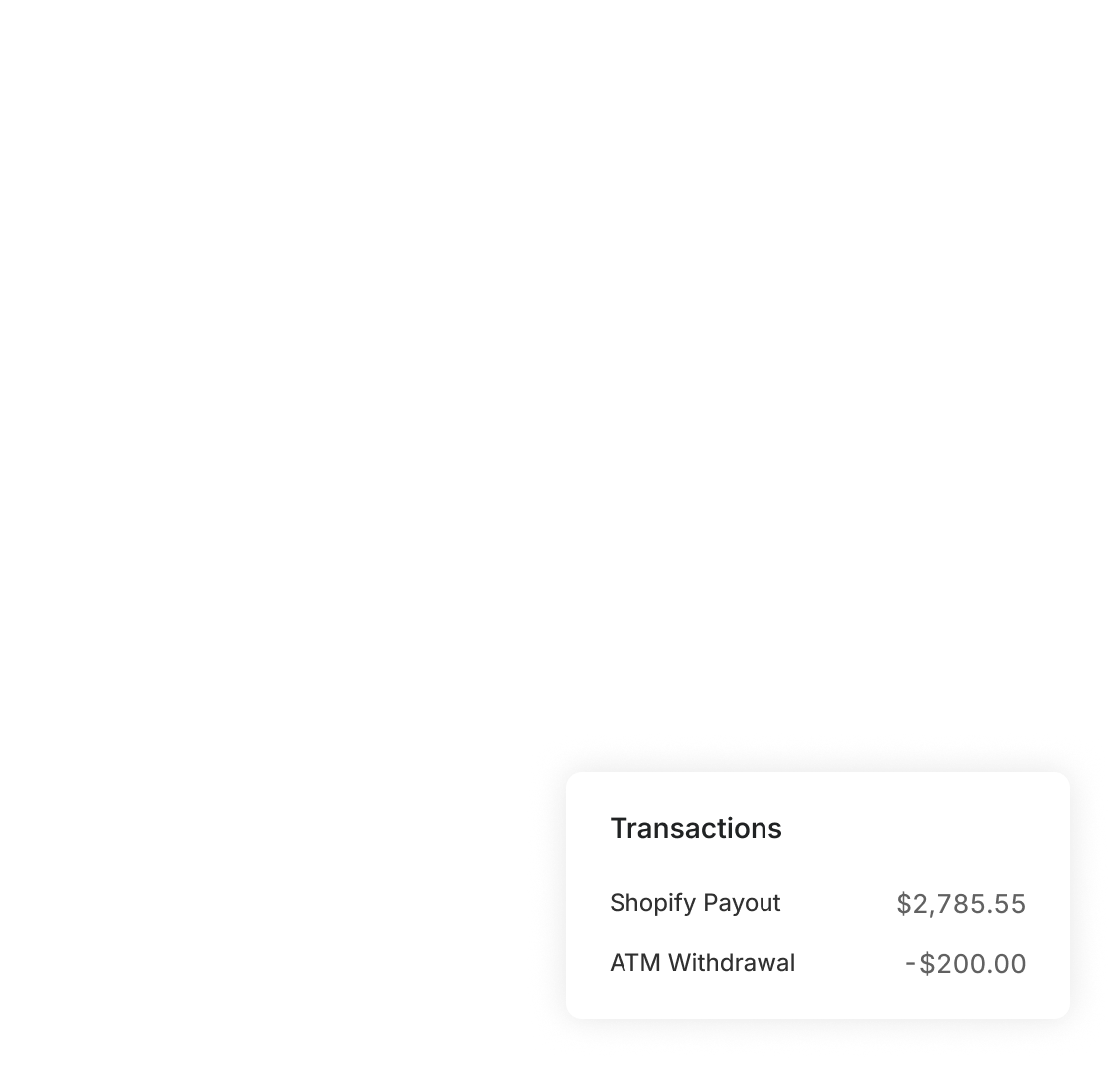

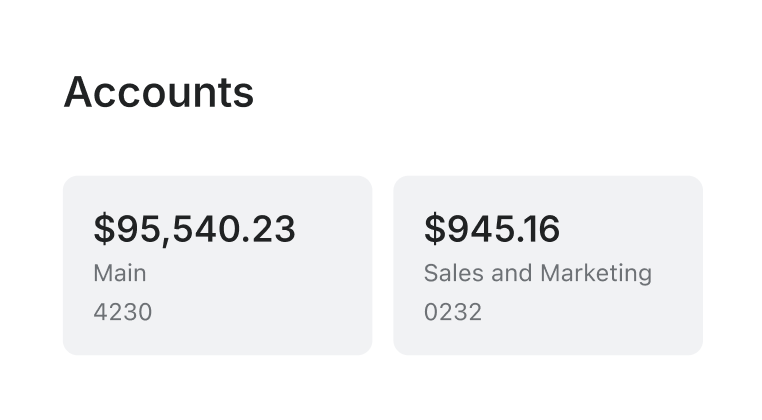

Manage your money where you make it

Get a complete view of your business finances with dashboards, filters, and reports.

Spend virtually and in person

Earn cashback rewards for everyday business purchases, everywhere Visa® cards are accepted.3

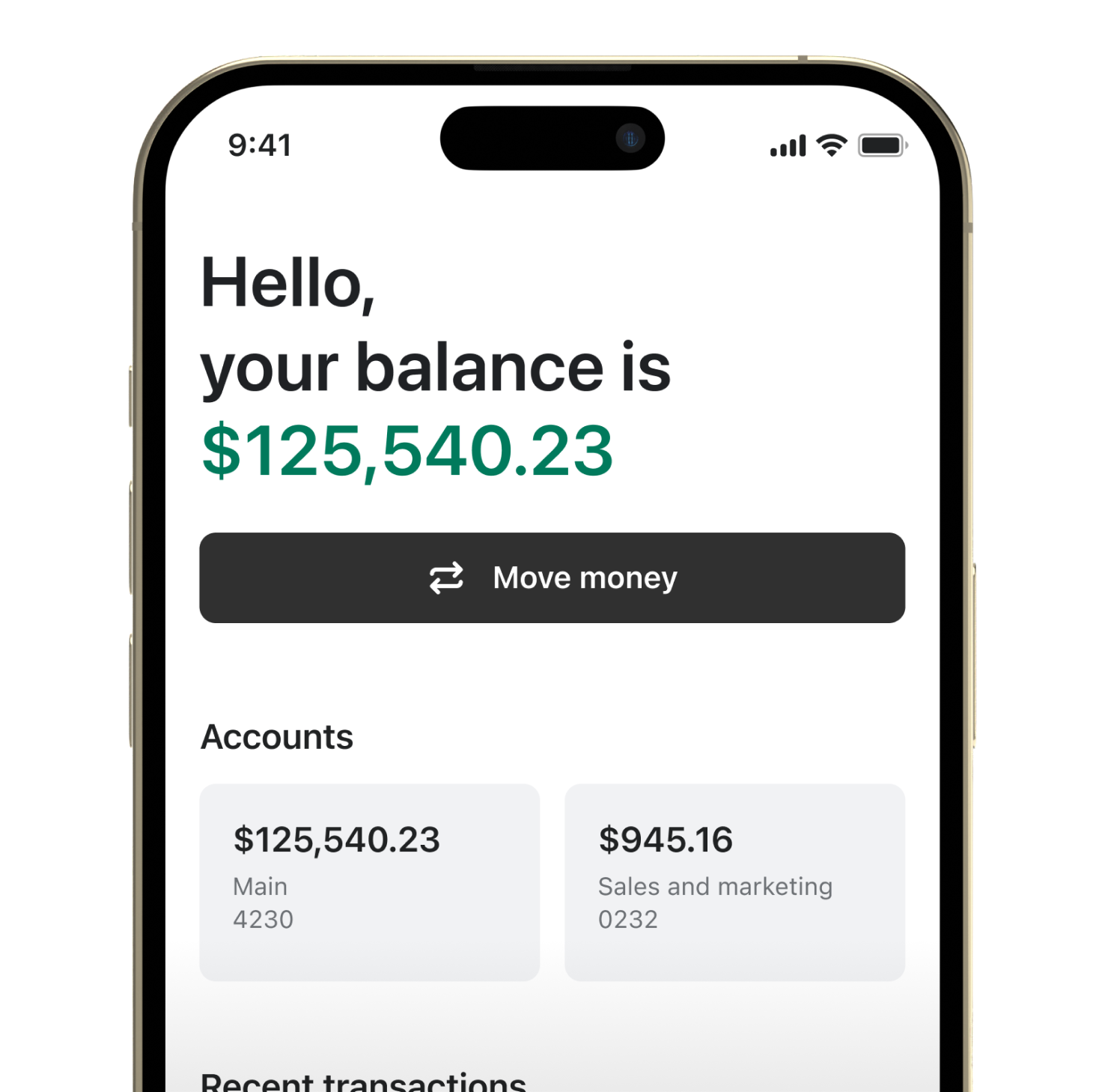

Make money moves on the go

Take the power of Balance everywhere you go with the Shopify Balance mobile app.

2 Shopify provides a reward in the form of an annual percentage yield on the money you hold in Shopify Balance, and it is not interest. The rate is variable, subject to change without notice, and accurate as of October 17, 2024. The reward accrues daily, and is compounded and paid monthly in the form of a credit to your Balance account.

Not a bank account. Better.

Streamline business finances and make better money moves.

Skip the fees

No monthly, transfer, or ATM fees.1 Plus, no minimum balance required.

Get paid faster

Receive money from your Shopify sales up to 7 days earlier than a bank.4

Make money on your money

Put more money into your business with an APY reward on any account balance.2

Stay on top of your finances

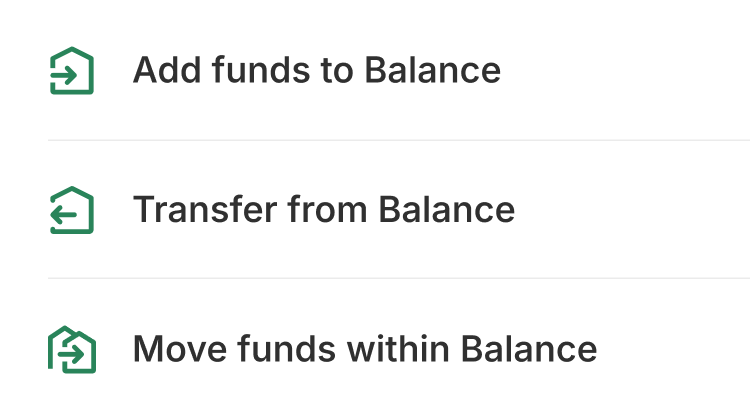

Open up to 5 extra accounts to organize funds—from bills and taxes to inventory and more.

Simplify taxes

Automatically set aside sales tax and sync transactions to popular accounting software.

Earn cashback on spending

Get a free spending card and earn cashback on eligible purchases.3

Safeguard your finances

Trust your finances to the same partner that helps your business thrive.

Industry standard coverage

Your Balance account is eligible for FDIC insurance up to $250,000.5

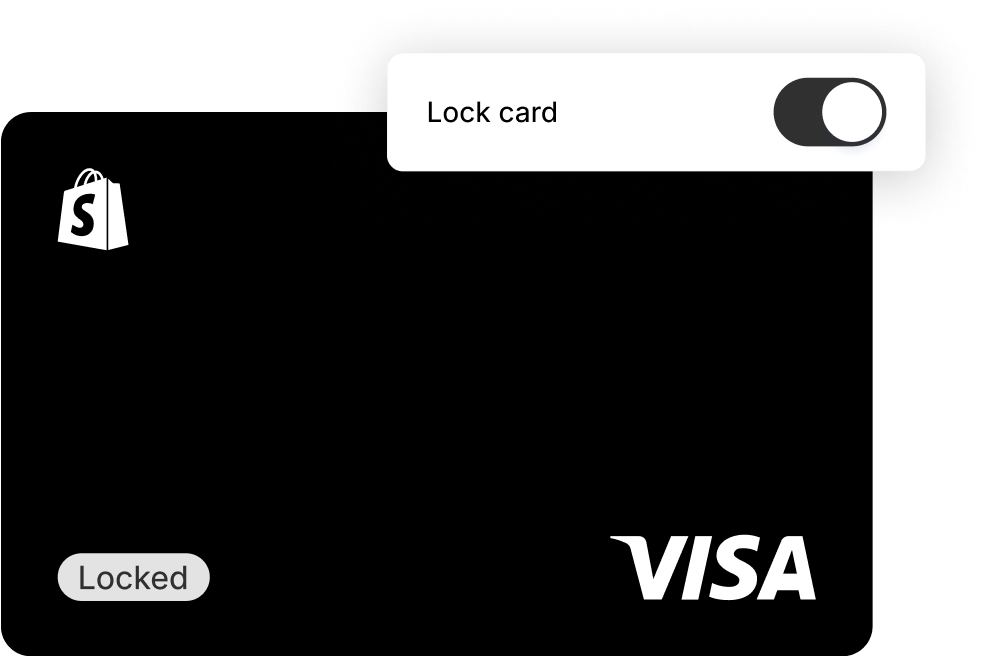

Manage your spending card

Protect your money at all times. Lock and unlock your card right from your admin.

Support you need, when you need it

Reach out to our support team via live chat 24/7.

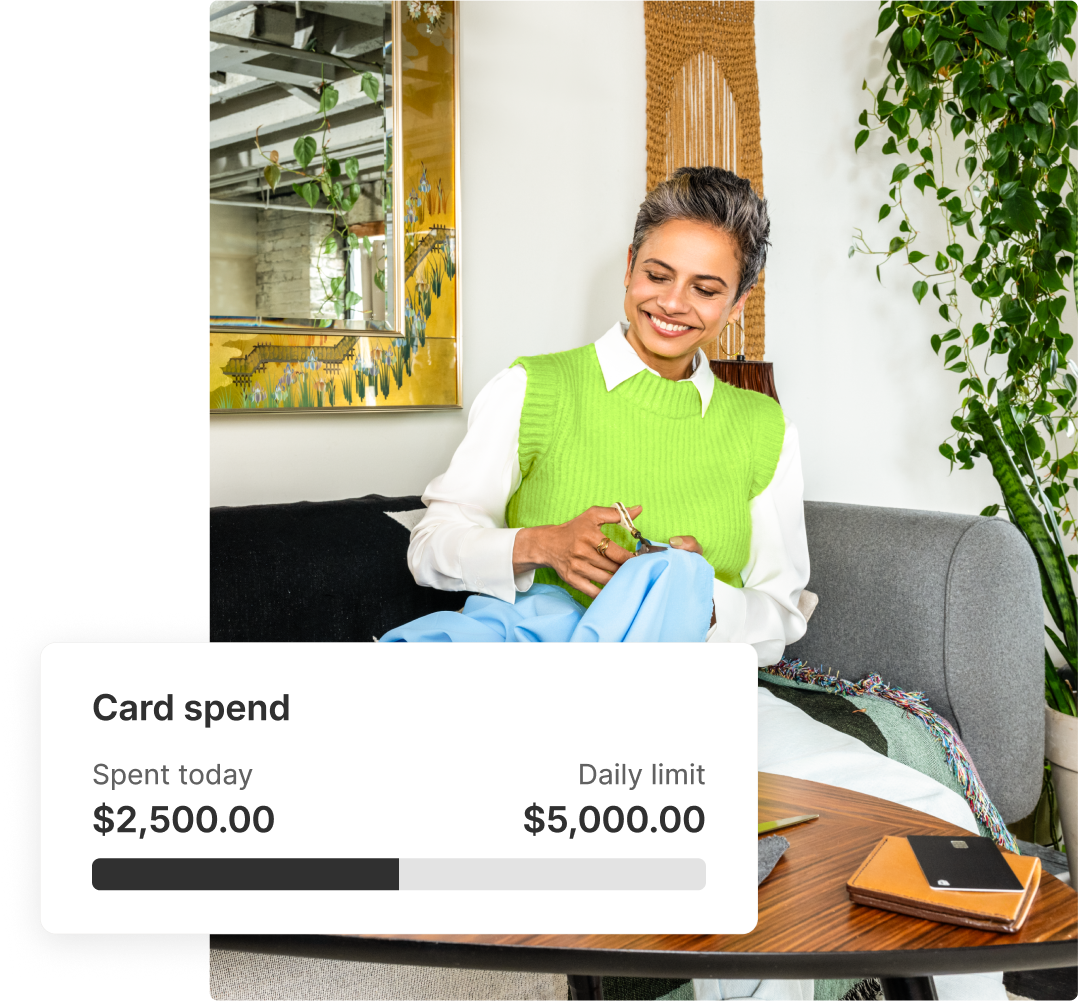

Spend your money, your way

Use your spending card for everyday business purchases, in-store or online.

Get a custom card for your business

Receive a virtual card instantly and order a free physical card customized with your business name.

Use your card wherever Visa® is accepted

Pay bills, make business purchases, and withdraw cash at thousands of ATMs worldwide.1

Take advantage of Visa® benefits

Enjoy exclusive Visa® benefits, including rental car collision damage, travel and emergency assistance, and more.

Earn rewards you can use

It pays to spend on your business with your Balance account.

2% cashback on business must-haves

No points to redeem, just real money to earn. Your rewards never go to waste with automatic cashback on eligible business purchases.3

Exclusive partner perks you can’t say “no” to

Unlock exclusive offers from Google, Snapchat, and other industry-leading partners to run and promote your business.

Exclusive features for Shopify Plus

Balance adds even more value to your business when you’re on Shopify Plus.

4.43% APY reward

All your funds in Balance—including deposits—earn a reward of 4.43% annual percentage yield.2

The fastest payouts

Access store profits in one business day by default, so you can start earning or spending ASAP.4

Up to $1M transfers

Get daily transfer limits—up to $1,000,000—tailored to your business.6

Get rewarded

Your money grows in Balance every month and compounds over time—no minimum or maximum limits on your account balance.

Earnings over time

The calculator is for illustrative purposes only. It assumes no rate changes and that your account balance at year 1 and all APY accrued remains in Shopify Balance.

Shopify Balance

- No monthly, transfer, or hidden fees1

- No minimum balance

- $0 ATM fees charged by Shopify1

- Skip the paperwork and sign up online in minutes

- Get paid as fast as the next business day4

- Automatically set aside sales tax

- Manage your money and business from one place

- Earn up to $2,000 cashback every year3

Traditional banks7

- $10+ average monthly fees

- Up to $5,000 minimum balance

- Up to $5 ATM fees in addition to ATM provider fees

- In-person application that can take weeks to approve

- Payments may take up to 7 business days

- Complex tax integrations

- Finances and business managed on multiple platforms

- Limited or no cashback from bank accounts

Before Shopify Balance, my finances were all over the place. Shopify Balance helps streamline everything and keep my finances organized.

Shopify Balance

Easier. Faster. More rewarding.

Don’t have a Shopify store? Start your trial—free

Resources

Get started with Shopify Balance

Learn how to manage your Shopify Balance account, card, and mobile app.

How to manage your business finances

Get expert tips on streamlining money management for your business.

Get the support you need

Reach out to Shopify’s dedicated team by live chat, email, or phone.

Recommended for you

Easily pay, schedule, and manage expenses from the same platform where you run your store.

Turn everyday business purchases into even more cashback rewards with the pay-in-full card designed for entrepreneurs.8

Apply for founder-friendly capital to power your business. Keep bestsellers in stock, amplify your marketing, and more.9

Frequently asked questions

- Shopify partners with Stripe Payments Company for money transmission services and account services with funds held at Evolve Bank & Trust and Fifth Third Bank, Members FDIC. Shopify Balance Visa® Commercial Credit cards are powered by Stripe and issued by Celtic Bank pursuant to a license from Visa U.S.A. Inc.

- 1. Shopify Balance has no monthly, transfer, or hidden fees. Shopify doesn’t charge any ATM withdrawal fees, but you may be charged by an ATM provider.

- 2.Shopify provides a reward in the form of an annual percentage yield (APY) on the money you hold in Shopify Balance, and it is not interest. The rate is variable, subject to change without notice, and accurate as of October 17, 2024. The reward accrues daily, and is compounded and paid monthly in the form of a credit to your Balance account.

- 3.Earn up to $2,000 USD cashback on all eligible purchases per calendar year. This cashback limit may not apply to Shopify Partner offers. Learn more

- 4.For stores on the Basic, Shopify, or Advanced plans, Shopify Payments payouts are deposited in your Balance account within 5 business days, but most merchants will receive payouts within 1-3 business days. For stores on the Plus plan, payouts are deposited the next business day by default. Payout speed may be subject to change without notice.

- 5.Shopify Balance accounts are eligible for FDIC insurance up to $250,000 USD per depositor through Evolve Bank & Trust and Fifth Third Bank, Members FDIC. Stripe Treasury Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same type of account (business versus personal, and so on). Neither Stripe nor Shopify are an FDIC insured institution and the FDIC’s deposit insurance coverage only protects against the failure of an FDIC insured depository institution.

- 6.Transfer limits are subject to change without notice.

- 7.Traditional bank accounts are comprised of publicly available data from select business bank accounts of the top three largest US banks by assets.

- 8.Shopify Credit Visa® Commercial Credit cards are powered by Stripe and issued by Celtic Bank pursuant to a license from Visa U.S.A. Inc. See Issuing Bank Terms and Shopify Credit Program Terms.

- 9.All loans in the US through Shopify Capital are issued by WebBank.